Investing with Sofi: A Beginner’s Guide

Page Contents

Investing with Sofi: A Beginner’s Guide

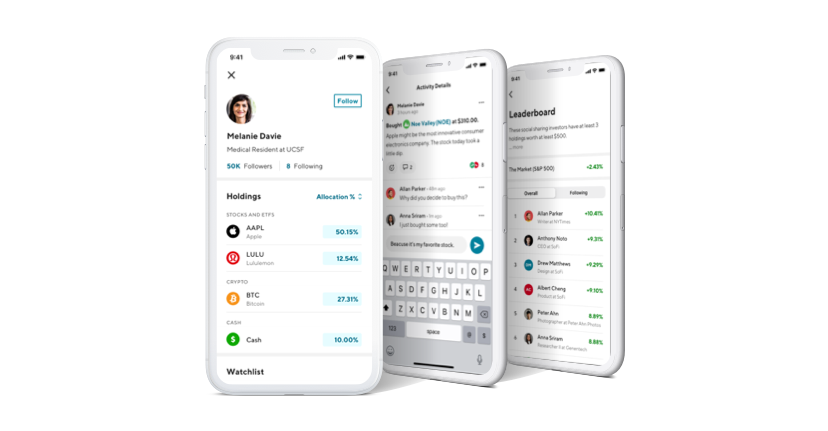

Investing with Sofi provides beginners with a seamless way to explore various investment options, including stocks, ETFs, and cryptocurrency. Whether you’re looking for hands-on stock trading or automated investing, investing with Sofi allows you to tailor your portfolio to match your financial goals and risk tolerance. You can choose to invest in individual stocks if you prefer a hands-on approach, or opt for ETFs that provide exposure to a broader market without the need to pick individual companies.

This flexibility is particularly beneficial for those who are new to investing or those who want to take a more passive approach. Moreover, Sofi also provides automated investing options through its robo-advisor service. This feature is designed for individuals who may not have the time or expertise to manage their investments actively.

By answering a few questions about your financial situation and goals, you can receive personalized investment recommendations that align with your objectives. This means you can start investing even if you’re not well-versed in the intricacies of the stock market, making it an accessible option for everyone.

Key Takeaways

- Sofi offers a range of investment options including stocks, ETFs, and cryptocurrency to cater to different investment preferences.

- Setting up an investment account with Sofi is a simple and straightforward process that can be completed online in a few easy steps.

- Sofi provides various investment strategies such as automated investing, active investing, and retirement accounts to help users achieve their financial goals.

- Managing investments with Sofi is convenient with features like automatic rebalancing and dividend reinvestment to optimize portfolio performance.

- Sofi’s investment platform offers a variety of tools and resources including educational content, market insights, and financial planning calculators to assist users in making informed investment decisions.

Setting Up an Investment Account with Sofi

Creating an Account

To get started, simply visit the Sofi website or download the mobile app, where you’ll be prompted to create an account. You’ll need to provide some personal information, such as your name, email address, and Social Security number, which is standard practice for any financial institution.

Verifying Your Identity and Funding Your Account

Once you’ve filled out the necessary details, you’ll be asked to verify your identity, ensuring that your account remains secure. After your identity is confirmed, you can fund your account through various methods, including bank transfers or direct deposits.

💡 A Personal Tip: I’ve personally used SoFi for banking for a long time, and one of my favorite features is their high-yield savings account with a 3.80% APY. It makes transferring money instantly between checking and savings seamless, allowing me to maximize my earnings. Additionally, when I pay off my credit card each month, I can redeem reward points directly into my Active Investing account, making funds available for investment immediately. This effortless integration helps me stay consistent with my financial goals.

Starting Your Investment Journey

Sofi makes it easy for you to start investing right away by allowing you to set up automatic contributions. This feature enables you to invest consistently over time, which can be particularly advantageous for building wealth through dollar-cost averaging. With your account set up and funded, you’re ready to explore the investment options available and begin your journey toward financial growth.

Get $25 worth of your favorite stock!

Choosing the Right Investment Strategy with Sofi

Choosing the right investment strategy is crucial for achieving your financial goals, and Sofi provides several avenues to help you make informed decisions. One of the first steps is to assess your risk tolerance and investment timeline. Are you looking for short-term gains, or are you willing to invest for the long haul?

Understanding your financial objectives will guide you in selecting the most suitable strategy. Sofi’s platform offers educational resources that can help clarify these concepts, ensuring that you feel confident in your choices. Additionally, Sofi allows you to customize your investment strategy based on your preferences.

If you’re interested in socially responsible investing, for instance, you can select funds that align with your values. Alternatively, if you prefer a more aggressive approach, you might focus on high-growth stocks or sectors poised for expansion. The platform’s user-friendly interface makes it easy to explore different strategies and adjust them as needed, giving you the flexibility to adapt your approach as market conditions change.

Managing Your Investments with Sofi

| Investment Option | Minimum Investment | Management Fee | Account Types |

|---|---|---|---|

| Stock Bits | 1 | 0% | Individual, Joint, Traditional IRA, Roth IRA, Crypto |

| Active Investing | 1 | 0% | Individual, Joint, Traditional IRA, Roth IRA, Crypto |

| Automated Investing | 1 | 0.25% | Individual, Joint, Traditional IRA, Roth IRA |

Once you’ve established your investment strategy, managing your investments effectively is key to long-term success. Sofi provides a comprehensive dashboard that allows you to track your portfolio’s performance in real-time. You can view detailed analytics on how each asset is performing and make adjustments as necessary.

This level of transparency empowers you to stay informed about your investments and make data-driven decisions. Moreover, Sofi offers features that enable you to rebalance your portfolio easily. As market conditions fluctuate, certain assets may outperform others, leading to an imbalance in your desired asset allocation.

With just a few clicks, you can sell off overperforming assets and reinvest in underperforming ones to maintain your target allocation. This proactive approach helps mitigate risk and ensures that your portfolio remains aligned with your investment goals.

Utilizing Sofi’s Tools and Resources for Investing

Sofi goes beyond just providing investment options; it also equips you with a suite of tools and resources designed to enhance your investing experience. One of the standout features is the educational content available on the platform. From articles and webinars to podcasts and tutorials, Sofi offers a wealth of information that can help deepen your understanding of investing concepts and strategies.

This educational focus is particularly beneficial for novice investors who may feel overwhelmed by the complexities of the market. In addition to educational resources, Sofi provides analytical tools that allow you to evaluate potential investments thoroughly. You can access performance metrics, historical data, and expert insights that can inform your decision-making process.

By leveraging these tools, you can make more informed choices about where to allocate your funds, ultimately increasing your chances of achieving favorable returns.

Diversifying Your Portfolio with Sofi

Diversification is a fundamental principle of investing that helps mitigate risk while maximizing potential returns. With Sofi’s platform, diversifying your portfolio has never been easier. You can invest in various asset classes, including stocks, bonds, and ETFs, which allows you to spread your investments across different sectors and industries.

This strategy reduces the impact of any single asset’s poor performance on your overall portfolio. Sofi also offers thematic investing options that enable you to invest in specific trends or sectors that interest you. For example, if you’re passionate about renewable energy or technology innovation, you can find funds that focus on these areas.

By aligning your investments with sectors you’re enthusiastic about, not only do you enhance diversification but also increase the likelihood of staying engaged with your portfolio over time.

Monitoring and Evaluating Your Investments with Sofi

Monitoring and evaluating your investments is essential for ensuring that you’re on track to meet your financial goals. With Sofi’s intuitive platform, keeping an eye on your portfolio’s performance is straightforward. You can set up alerts for significant market movements or changes in asset performance, allowing you to react promptly when necessary.

This proactive approach helps you stay informed and engaged with your investments. Additionally, regular evaluations of your portfolio are crucial for making informed adjustments. Sofi encourages users to review their investments periodically—whether it’s monthly or quarterly—to assess whether their current strategy aligns with their goals.

By analyzing performance metrics and comparing them against market benchmarks, you can identify areas for improvement and make necessary changes to optimize returns.

Maximizing Your Returns with Sofi’s Investment Platform

To maximize your returns using Sofi’s investment platform, it’s essential to take advantage of all the features available at your disposal. One effective strategy is to utilize automatic rebalancing tools that help maintain your desired asset allocation without requiring constant oversight from you. This feature ensures that as certain investments grow or decline in value, your portfolio remains aligned with your risk tolerance and investment objectives.

Furthermore, consider taking advantage of Sofi’s referral program and promotions that may offer bonuses for new accounts or additional funds for referrals. These incentives can provide an extra boost to your investment capital without requiring additional effort on your part. By leveraging these opportunities alongside a disciplined investment strategy, you can significantly enhance your potential returns over time.

In conclusion, investing with Sofi offers a comprehensive suite of options and tools designed to empower you on your financial journey. From understanding various investment options and setting up an account to managing and maximizing returns on your investments, Sofi provides a user-friendly platform that caters to both novice and experienced investors alike. By taking advantage of these resources and maintaining a proactive approach toward managing your portfolio, you’re well-positioned to achieve your financial goals and build lasting wealth.

If you are interested in learning more about building wealth and financial security, you may also want to check out this article on life insurance and wealth building. Life insurance can be a valuable tool in your overall financial strategy, providing protection for your loved ones and helping to build wealth over time. Additionally, having a solid emergency fund is crucial for financial stability. You can read more about how to build a 3-6 month emergency fund in this informative article here.

Get $25 worth of your favorite stock!

Thanks For Taking Your Time To Read This,

Remember To Share This Post On Social Media With Your Friends & Family

YouTube – Facebook – Instagram and Pinterest Pages!

Thanks For Your Support,

– Investing On The Go