How a 10.5% Market Surge Can Make or Break Your Portfolio

Page Contents

How a 10.5% Market Surge Can Make or Break Your Portfolio

A 10.5% market surge could be the key to growing your investment portfolio, but only if you’re prepared to stay invested.

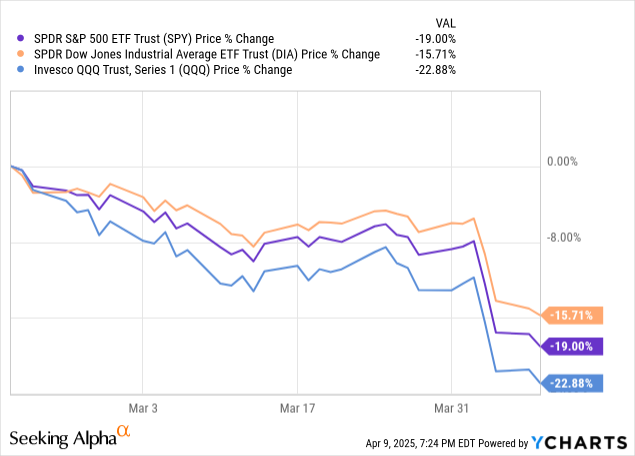

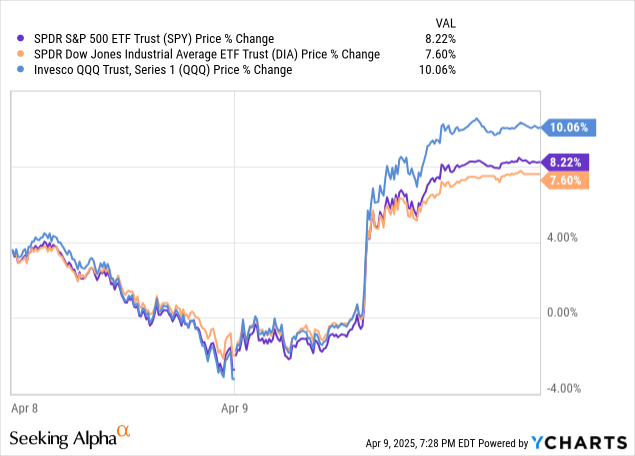

Imagine watching the market. It drops 20%, and your $10,000 portfolio shrinks to $8,000. Fear sets in, and you sell thinking the worst is yet to come. But just a few days later, the market bounces back with a 10.5% surge.

That would’ve been an $840 gain… if you were still invested.

It’s moments like this that highlight how powerful staying invested can be. Missing just one major recovery day can significantly impact your long-term returns.

Here’s the crazy part those big gains? They often show up right after the worst drops.

According to Fidelity, investors who missed just the 5 best days in the market over the last few decades earned way less than those who simply stayed put.

This isn’t about being overly optimistic—it’s about knowing that time in the market beats trying to time the market.

What a 10.5% Day Could Look Like for Your Portfolio:

💵 $100 → +$10.50

💰 $1,000 → +$105

💳 $10,000 → +$1,050

🏦 $25,000 → +$2,625

💼 $50,000 → +$5,250

📊 $100,000 → +$10,500

🏡 $250,000 → +$26,250

🚗 $500,000 → +$52,500

🧠 $1,000,000 → +$105,000

It’s wild, right? Whether you’re just starting or you’re well into your investing journey, those gains are real, and missing them stings.

It’s all about perspective. A loss or gain like that can feel like a windfall—or a missed opportunity—depending on your approach.

Key Takeaways

- A 10.5% market recovery in one day can mean thousands in gains depending on your portfolio size

- Staying invested can reward long-term investors when volatility strikes

- Selling during corrections may cause you to miss the strongest days of market recovery

- Diversification and consistent contributions like dollar-cost averaging help smooth out short-term volatility

Start Investing – Claim Your $25 Today!

My Personal Investing Philosophy

How My Strategy Has Evolved Over Time

As someone who’s been investing for over a decade, I’ve learned to trust the process. At 39, I no longer worry about short-term dips or headlines that used to shake me. Instead, I focus on monthly contributions and tracking my net worth—rain or shine.

Monthly Tracking & Platforms I Use

I track my net worth and investment performance monthly using tools like:

- SoFi: For both investing and my high-yield savings account (3.80% APY)

- Wealthfront: Automated portfolio management and tracking

By staying consistent and reviewing my progress monthly, I stay motivated without panicking during downturns.

Why I Don’t Sell in Downturns

I reinvest dividends even when the market is down. Selling during a dip only locks in losses. I’ve seen friends try to time the market and miss the recovery, waiting endlessly for the “next dip.” I’d rather stay in and DCA (dollar-cost average), slowly buying while prices are lower.

If I cashed out now, I’d risk missing the next big recovery. And with 20 years until I’m 60, I’m playing the long game.

The Pain of Selling Too Soon

One of the biggest mistakes new investors make is selling during a downturn. When fear takes over, logic often goes out the window. But history shows that some of the biggest upswings come right after the steepest drops.

Missing just a handful of the best market days can drastically cut long-term gains. Those who sell during a 10-20% correction might miss the very rebound that puts them back ahead.

By staying invested, you give yourself a chance to recover and grow. The longer your time horizon, the more patience pays off.

Sell during a 20% downturn, and you could miss the exact rebound that gets you back on top.

Why Dollar-Cost Averaging Works

Trying to time the market perfectly is nearly impossible even for professionals. That’s why I rely on dollar-cost averaging. I contribute a small amount weekly, no matter what the market is doing.

This strategy helps me buy more shares when prices are low and smooth out my average purchase price over time. Even if I’m investing while the market is red, I know I’m building long-term wealth.

Platforms that make this easy for me, I increase my daily deposit during these downturns to average in slowly as if falls, versus trying to time the market.:

-

SoFi Invest – Great UI, $25 bonus to start

-

M1 Finance – Ideal for dividend lovers

-

Robinhood, Webull, Public – All offer free stock promos to get started

The Magic of Compounding During Surges

A 10.5% jump is huge, but if your money is compounding, that jump becomes part of a long-term snowball.

Let’s say you start with $10,000 and get a 10.5% boost in year one, then keep earning 7% a year after that:

In 20 years, you’re sitting on more than $40,000. That single day gave you a head start that compounds over and over.

It’s not just about one day—it’s about building momentum that keeps rolling.

How to React When the Market Moves Big

When the market jumps nearly 10% in a day, it’s natural to feel either excitement or regret—depending on your position. But remember: the market will always move. What matters is your consistency, not your reaction.

If you’re invested, celebrate the gain. If you’re not, let it serve as a reminder to start—even if you’re starting small.

Final Thoughts

A single 10.5% gain in one day is a powerful reminder that markets can turn quickly. It’s why we stay invested. It’s why we diversify. And it’s why we focus on long-term wealth, not short-term headlines.

Whether you’ve got $100 or $1 million invested, the gains are real—and they grow over time.

So the next time the market dips, remember: recovery might be just a day away.

What would a 10.5% day mean for you?

👇 Drop your thoughts in the comments or let’s chat about your investing journey.

Start Investing – Claim Your $25 Today!

FAQs

Q: What causes the market to jump 10% in one day?

A: Major positive economic news, earnings surprises, or government stimulus can trigger big market rallies.

Q: Is it too late to invest after a big surge?

A: Not at all. Time in the market beats timing the market. Start small and invest consistently.

Q: Should I sell after a big jump?

A: Not if you’re in it for the long haul. Selling could trigger taxes and might miss further upside.

Q: How often do these big days happen?

A: Rarely—but they make up a huge portion of long-term returns. Missing them hurts your overall growth.

Thanks For Taking Your Time To Read This,

Remember To Share This Post On Social Media With Your Friends & Family

YouTube – Facebook – Instagram and Pinterest Pages!

Thanks For Your Support,

– Investing On The Go